Explain the Different Theories of Exchange Rate Determination

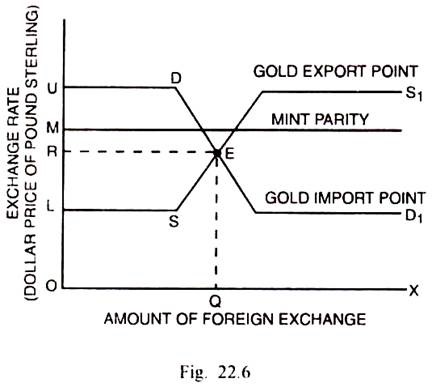

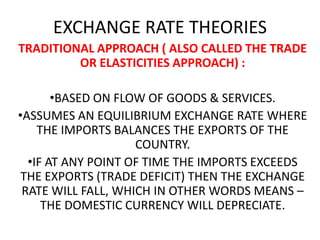

The earliest theory of foreign exchange has been the mint parity theory. The balance of payment approach treats exchange rates as determined in flow markets while the asset.

Theories Of Foreign Exchange Mba Knowledge Base

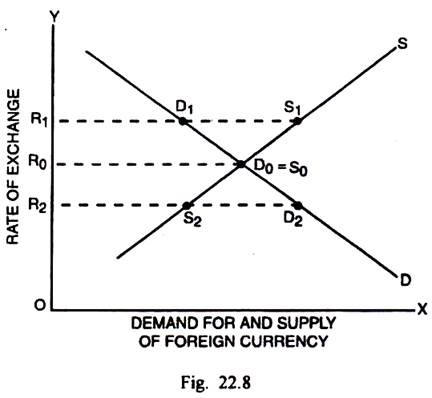

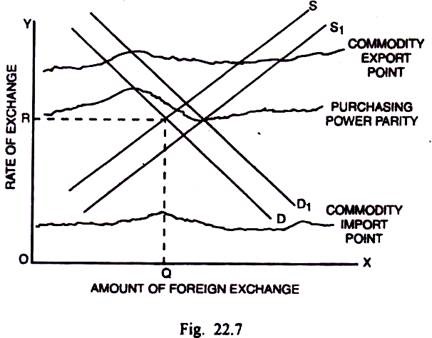

The floating exchange rates as discussed previously are determined by the market focus of demand and supply.

. 3 Asset approach to exchange rates. Third central bank intervention and its effects on exchange rates are discussed. International Fisher Effect IFE Theory 4.

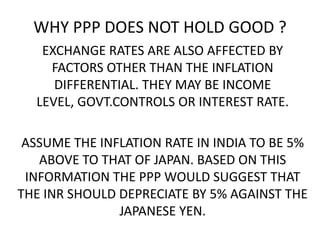

The purchasing power parity theory enunciates the determination of the rate. Even with the contrasting literature there was always belief that the PPP theory holds the potential to the theoretical solution to exchange rate determination. This article throws light upon the three theories of determination of foreign exchange rates.

These are not influenced by government intervention. Some approaches to exchange rate determination. PPP equilibrium story 1.

It is also known as the floating exchange rate. Purchasing Power Parity Theory 2. Unbiased Forward Rate Theory UFR.

Thus we need to explain why the exchange rate will change if it is not in equilibrium. The Purchasing Power Parity Theory. The Balance of Payments and the Internal-External Balance Approach 3.

The Purchasing Power Parity Approach. The Purchasing Power Parity Approach 2. The following points highlight the top four theories of exchange rates.

The following points highlight the five main approaches used for determining exchange rates. Different methods are used to forecast fixed and floating exchange rates. If a Mac Donald Burger costs 20 in the USA and Re 100 in India then the exchange rate between India and the USA will be 100205 1 5 Re.

Fixed exchange rate managed floating exchange rate or pegged exchange rate and flexible exchange rate. Since today there is no believer of purchasing power parity theory we consider only demand-supply approach to foreign exchange rate determination. Purchasing Power Parity Theory PPP 2.

The Portfolio Balance Approach 5. The balance of payment approach and the monetarist approach. Thus we explain below how the value of a dollar in terms of rupees which will.

It is sometimes referred to as a pegged exchange rate system since governments tend to keep an. Determination of Exchange Rates. Lets consider the case in which the exchange rate is too.

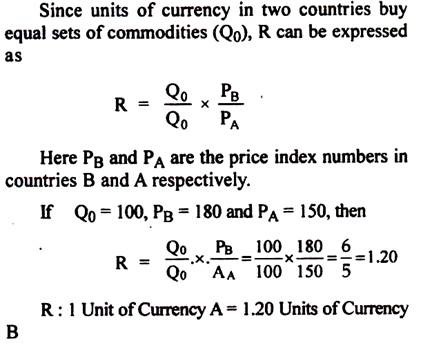

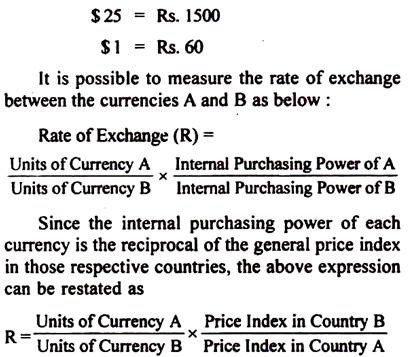

There two main theories we well study here. Theories of exchange rate determination Now we come to the question of how does the foreign exchange market determine what the exchange rate will be. According to Purchasing Power Parity theory the foreign exchange rate is determined by the relative purchasing powers of the two currencies.

Determination of exchange rates using supply and demand diagram. Interest Rate Parity Theory IRP 3. The first is known as the purchasing power parity theory and the second is known as the demand-supply theory or balance of payments theory.

Appreciation increase in value of exchange rate. Markets excess demand or excess supply will be corrected by a change in exchange rates. Forex rates are defined as the amount of your currency required to buy a foreign currency.

Level of trade of. In general there are always two versions of an equilibrium story one in which the endogenous variable E p here is too high and one in which it is too low. The exchange rates may be fixed or floating.

Forces Behind Exchange Rate Determination. Other Determinants of Exchange Rates. The equilibrium of goods market determine exchange rate according to purchasing power parity.

When the Balance of Payment is equilibrium the demand and supply for the currency are equal. Since the task of exchange rate theory is to explain be- havior observed in the real world the essay begins in sec. It can be decided via three methods which are.

This exchange rate is decided by the marketplace forces of demand and supply. We will present two different models that explicitly incorporate different views of the market for exchange rates. Purchasing Power Parity PPP theory holds that in the long run exchange rates will adjust to equalize the relative purchasing power of currencies.

Interest Rate Theories 3. The equilibrium of asset markets determine exchange rate according to portfolio model. An exchange rate that fluctuates or is flexible is called a floating.

Fixed exchange rates on the other hand are decided by the regulating agencies. The traditional approaches to exchange rate determination are based on the monetary approach the purchasing power parity PPP approach and the. The endogenous variable in the PPP theory is the exchange rate.

Theories of Exchange Rate Determination International Economics 1. How in a flexible exchange system the exchange of a currency is determined by demand for and supply of foreign exchange. In this example a rise in demand for Pound Sterling has led to an increase in the value of the to from 1 150 to 1 170.

Depreciation devaluation decrease in value of exchange rate. 1 The asset approach which is based upon interest rate parity. The equilibrium of money market determine exchange rate according to monetary model.

It weightily indicates the relative level of countrys economic health. We assume that there are two countries India and USA the exchange rate of their currencies namely rupee and dollar is to be determined. According to this theory the price of a commodity that is exchange rate is determined just like the price of any commodity is determined by the free play of the force of demand and supply.

As represented in the given figure the exchange rate is decided where the. The Mint Parity Theory. 12 with a summary of empirical regularities that have been characteristic of the behav- ior of exchange rates and other related variables during periods of floating exchange rates.

Have you ever thought how foreign exchange rates are determined and how it is concluded that today a dollar will be equal to 06 EUR. Purchasing Power Parity Theory PPP Theory Most widely accepted theory According to PPP theory when exchange rates are of a fluctuating nature the rate of exchange between two currencies in the long run will be fixed by their respective purchasing powers in their own nations ie the price of a good that is charged in one country should be equal to the one. The Monetary Approach 4.

Determination of Foreign Exchange Rate. Dornbusch and Krugman 1976 p540 stated that Under the skin of any international economist lies a deep-seated belief in some variant of the PPP theory of the exchange rate. Determination of Exchange Rate Flexible Exchange Rate.

Theories Of Exchange Rate Determination International Economics

Ch04 Exchange Rate Determination

Different Methods Of Forecasting Exchange Rates Video Lesson Transcript Study Com

Theories Of Exchange Rate Determination International Economics

Purchasing Power Parity Theory

Theories Of Foreign Exchange Rate Movement And International Parity Conditions With Case Study

Theories Of Exchange Rate Determination International Economics

Theories Of Exchange Rate Determination International Economics

Theories Of Exchange Rate Determination International Economics

Comments

Post a Comment